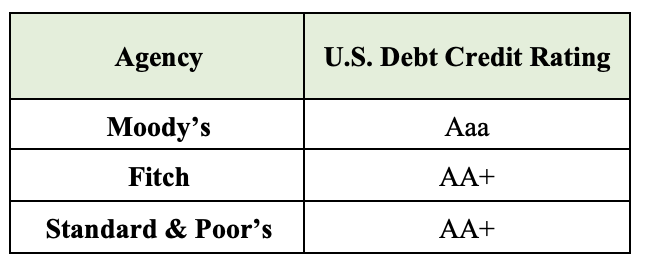

A few days ago my editor and friend, Fitz, suggested that I take a look at a somewhat under-publicized story — the downgrade of U.S. sovereign debt by Fitch, one of the “Big Three” credit rating agencies. Boring stuff, right? I thought so too until I read about Fitch’s reasoning for downgrading us from AAA to AA+. What I learned made me wonder why Fitch alone had notched down our rating, which essentially measures the U.S.’s ability to repay its debts. (Credit ratings do matter, by the way. When they drop, interest on debt often rises, making borrowing money more expensive.) Of the three rating agencies, Fitch alone downgraded us. Standard and Poor’s apparently believes our financial underpinnings are as sound as they were 12 years ago, when it lowered our rating from AAA to AA+. (Since then our national debt has more than doubled, from $14.8 trillion to $31.4 trillion). As for Moody’s, its silence suggests it doesn’t share Fitch’s concerns about our country’s financial (mis)management.

Several high-powered economists in U.S. public life roundly excoriated Fitch for its downgrade. Treasury Secretary Janet Yellen called it “arbitrary and based on outdated data”. Former Treasury Secretary Larry Summers described the downgrade as “absurd and inept” while stating that the U.S. economy now looks stronger than was predicted a few months ago. The debate then was not whether we’d have a recession — but when — and whether it would be hard or soft.

Summers, Yellen and the rest of the economic elite were so busy harrumphing that they missed Fitch’s larger message. You’d have thought Fitch said our economy was about to crash into the rocks. In fact, Fitch simply articulated in blunt language a fact obvious to anyone who’s awake and aware: Governance in the U.S. is dysfunctional because our politics is broken. Who can argue with that?

Fitch was spooked by repeated debt limit standoffs, and shouldn’t we all be? House Republicans — the ones threatening to impeach Joe Biden — brought the country to the brink of default once already this year. True, we narrowly averted defaulting on our bills, but that’s small consolation because we’ll probably find ourselves right back at the precipice a year from now, if not sooner. A different kind of budget showdown is only weeks away and who knows how that one will turn out?

So Exhibit No. 1 for justifying Fitch’s downgrade is the increasingly real possibility of default — a once inconceivable prospect because we took seriously the seismic consequences to economies here and abroad. Yet default is a card Republicans now seem willing to play. Why? For no better reason than to score points against Biden and Democrats in the ultimately ruinous game of revenge politics, which plays out daily in and outside Washington.

The Republicans’ leader, the self-anointed “art of the deal” wizard who left a trail of bankruptcies before swaggering into the White House, actually advocated default in a speech at one of his country clubs earlier this year. Despite such recklessness by him and like-minded lackeys in Congress, Moody’s and S&P haven’t cut their ratings. Doing so would seem like a logical step when, time after time, Republicans choose to play Russian roulette with our economy.

But it’s not just them, not just the shenanigans of hard-right goons like Matt Goetz, Lauren Bobert, Marjorie Taylor Greene and Tommy Tuberville, who can’t wait to throw their next temper tantrum. They and their ilk have given us a cream-puff House speaker who meekly asks, “How high?” when they order him to jump. Ironically, Kevin McCarthy’s lust for the power of the speakership has rendered him virtually powerless — beholden to the far right, always in its crosshairs.

So yes, there’s ample evidence of our government’s dysfunction. But something more fundamental underlies our problems, credit downgrades included. The mess so aptly described by Fitch is the upshot of our win-at-any-cost, two-party political system that renders creative problem-solving impossible. One can’t imagine our two parties loosening their grasp on power and instead working together for the common good of regular working Americans.

Let me assign blame on both sides so I won’t be accused of left-wing bias — even though I am proud of my left-wing bias.

First, the Republicans. In addition to being in thrall of a tacky, disgraced huckster, the GOP is shamelessly aligned with the rich and the corporations that make them rich. The Trump tax cuts were a boon to large corporations and the wealthiest 1 percent, and there’s no reason to think that Republicans will ever stop kow-towing to their well-heeled benefactors.

Then there’s Biden and the Democrats. Biden’s super-charged Covid relief spending, plus his expensive infrastructure bill, both came on the heels of Trump’s tax cuts. Not surprisingly, soaring deficits ensued. Both parties contributed to our diminished fiscal status, as Fitch noted. Fitch’s lead analyst, Richard Francis, put it this way: “There are definitely fiscal issues that have been done by both parties. The Trump tax cuts significantly impacted revenues in the past few years. The spending initiatives by the Biden administration have been perhaps needed but also costly.”

Francis’s last statement comes close to being a dangerous false equivalency. He concedes that Biden’s spending initiatives might have been needed, yet he seems to say that both parties deserve blame for the fiscal hole we’ve dug. Not true. Trump’s tax cuts were a gift to the rich — a huge one. The billions the cuts added to the debt was somehow OK with today’s Republican Party, which historically has patted itself on the back for being the only fiscally responsible party. But this go ’round Republicans worried not a whit about the country’s deteriorating bottom line. Why? Because the tax cuts ballooned the personal wealth of the party’s biggest contributors. Those contributors, in turn, want to make sure the good times keep rolling, so they contribute generously to GOP candidates.

Compare the fat cats enriched by Trump’s tax cuts with the much broader swath of American workers whose paychecks evaporated during the pandemic. Covid relief checks helped keep their families afloat and jobs created by Biden’s infrastructure plan got them back to work. How can anyone say the actions of Trump and Biden were socially and morally equivalent? They are not.

I promised to assign fault to both parties. So here’s what I think the Democrats should do to bolster their fiscal bona fides.

- Target huge spending infusions more carefully to exclude the wealthy and large corporations. The billions of aid allotted to huge corporations during Covid was excess to the max. Surely some of the waste could have been prevented, perhaps with means-testing — that is, evaluating one’s income and assets to determine the appropriate amount of relief money. This criticism, by the way, applies to Republicans, too. But Dems need to work harder to stop giving away taxpayer dollars to individuals and entities that don’t need help.

- Be willing to means-test Social Security and Medicare. If the Dems cannot figure out ways to save billions in Social Security and Medicare expenses, they deserve to be called out for laziness and ignorance — and spinelessness for refusing to touch the “third rail” of American politics. The fixes are too easy. First, you eliminate the cap on earned income subject to the Social Security tax. The more you make, the more you pay in. According to the Peterson Foundation, subjecting income above $250,000 to Social Security taxes would generate $1 trillion in revenue in 10 years. It would also make the Social Security tax less regressive, a tiny step toward economic justice. (See appendix for a link to the Peterson Foundation website, which shows the low-hanging fruit Dems could snatch to showcase their fiscal sanity.)

Bringing in more revenue, of course, would address only part of the Social Security dilemma. What if we capped Social Security benefits for people earning more than $500,000 per year to, say, $2,000 per month? How many billions would that save? We’d get similar results with Medicare by tinkering with revenues and expenses. Should 100 percent of my medical bills be paid by taxpayers when my post-retirement income exceeds my pre-retirement income? Trillions could be saved simply by having rich people pay a bigger share of their medical bills. We’d limit total Medicare coverage for those whose income exceeds a certain threshold.

Of course the MAGAs would oppose these changes because they target the wealthy. And Dems have never had the nerve even to suggest reforming Social Security and Medicare, fearing that sensible adjustments would be misconstrued as across-the-board meat-axing harmful to poor- and middle-income recipients. It’s way past time, though, for Dems to show some guts and make a case for safeguarding Social Security and Medicare. Rich people can afford it. They don’t stop being rich when they turn 65. If incumbent Democrats can’t sell that to the nation, then we need to elect some Democrats who can.

Now back to credit ratings. Were I on the rating committee of Fitch, Moody’s or Standard and Poor’s, I’d be in a state of high alarm because our situation is beyond daunting. We are choking on massive debt. The intransigence of our two political parties prevents even broaching the subject of meaningful fiscal reform. The mess gets kicked down the road with every passing quarter. All of this bespeaks governance of a country that in no way deserves the highest credit rating.

If I’ve convinced you that we’re in a pickle now, consider what happens if Trump is re-elected. With him back in the White House, we’ll look back with wistfulness on the days of AA+ ratings. Methinks Larry Summers and Janet Yellen protest too much. We richly deserve the downgrade by Fitch.

Editor’s note: Although Moody’s has been silent about U.S sovereign debt, it did weigh in on another important financial matter — one unrelated to sovereign debt. On Aug 7, Moody’s downgraded the credit ratings of 10 small- to mid-sized U.S. banks, citing growing financial risks and strains that could erode their profits. Moody’s also warned that it may downgrade credit ratings of several larger banks in the future.

Appendix: Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

Thanks for this post. I feel smarter after reading it.